The Consolidated Appropriations Act of 2021 (CAA 2021) opened the door to class action lawsuits against employer-sponsored health plans in several ways. Most notably by expanding fiduciary obligations, increasing required disclosures, and creating a paper trail that plaintiffs can exploit.

Now, the recent surge in lawsuits focusing on ERISA fiduciary obligations is proving that plan sponsors concerned about their litigation risk had right to be worried.

Plan participants and plaintiff firms are increasingly alleging that employers:

- Overpaid for healthcare services by not properly evaluating vendor pricing

- Breached fiduciary duties by ignoring conflicts of interest

- Failed to act prudently in selecting or monitoring PBMs or other vendors

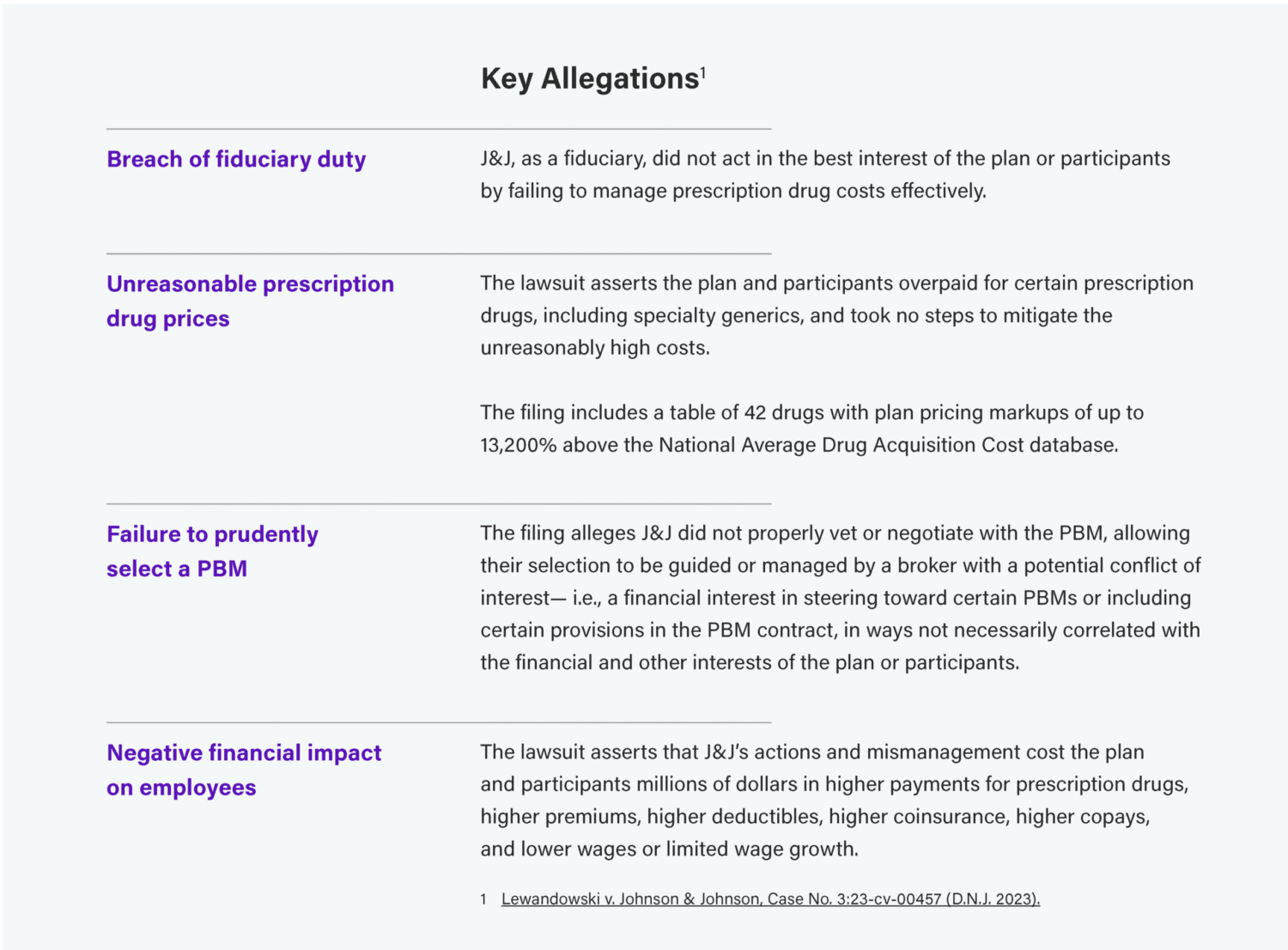

The most significant example so far is the Johnson & Johnson (J&J) lawsuit. Originally filed in February 2024, this new and novel legal case argues the company failed their “duty of prudence” when selecting a pharmacy benefits manager (PBM) and negotiating drug pricing.

Lewandowski v. Johnson & Johnson: A Wake-Up Call for Health Plan Fiduciaries

Overview: This class action lawsuit filed by a J & J employee principally involves mismanagement of prescription-drug benefits. The lawsuit claims J & J breached their fiduciary duties by failing to prudently select a pharmacy benefit manager (PBM) and by mismanaging J & J’s prescription-drug benefits program by failing to negotiate favorable pricing.

In a noteworthy move, the lawsuit also seeks to hold specific individuals within Johnson & Johnson personally liable as fiduciaries, including several HR executives and 20 members of the Pension & Benefits Committee.

Lawsuit Status as of Aug 1, 2025:

The initial complaint was dismissed earlier this year for lack of standing. An amended complaint is currently under court review.

Implications for Self-Funded Plan Sponsors

The case marks one of the first major legal tests of how ERISA fiduciary rules apply to health plans post–Consolidated Appropriations Act of 2021. It also signals a new era of litigation risk for employers who don’t actively manage vendor performance and pricing transparency.

While the case is ongoing, it’s a clear reminder and warning for employers.

Fiduciary responsibilities extend to vendor management and cost oversight—especially around pharmacy benefits. Employers should review all their fiduciary obligations and maintain robust fiduciary procedures.

The lawsuit claims also underscore how important it is for employers to obtain clear and complete compensation disclosures from all service providers to understand any potential conflicts of interest

Fiduciaries and Their Duties Under ERISA

A fundamental issue is that many companies don’t know or misinterpret who exactly holds fiduciary responsibilities, and what those obligations mean.

Per the U.S. Department of Labor, fiduciaries are those persons or entities with discretionary control or authority over plan management or assets, and/or responsibility for plan administration.

Their responsibilities and duties include:

- Acting solely in the interest of plan participants for the exclusive purpose of providing benefits and paying plan expenses

- Prudently managing plan functions or hiring experts who can

- Following the terms of their ERISA-compliant plan document

- Avoiding conflicts of interest

- Not engaging in self-dealing or transactions that benefit parties related to other fiduciaries, service providers, or the plan sponsor.

The Significance of “Acting Prudently” as a Fiduciary

Acting prudently is the primary responsibility of fiduciaries under ERISA, requiring specialized knowledge and expertise. So first and foremost, employers who lack this internal expertise must engage qualified professionals and document their rationale for doing so. Other key practices:

- Keep the plan document up to date

- Ensure operations align with the plan’s terms

- Document decisions that impact the plan or its participants

Homestead’s Role as a Claims Fiduciary

As a third-party administrator, Homestead serves as the claims fiduciary authorized to make decisions on claim processing and payment.

Our fiduciary duty is limited to claims-related actions. We do not share the full fiduciary obligations of the employer or plan sponsor but are legally required to:

- Act in participants’ best interests

- Follow the plan document

- Administer claims fairly and prudently

Steps and Support to Reduce Your Risk

To minimize litigation risk, we recommend the following actions and can provide additional information and guidance if you need help getting started or have questions.

- Evaluate and monitor vendors to avoid real or perceived conflicts of interest

- Review plan designs regularly and document rationale for changes to cost-sharing or design.

- Keep plan documents current, amend as needed, and follow ERISA rules for participant communication

- Ensure timely compliance by filing required forms like the 5500 promptly

- Train decision-makers and educate employees on ERISA fiduciary duties

- Document all decisions, especially those that impact costs or participant benefits

- When in doubt—ask. Consult with your broker or Homestead contact about fiduciary questions

Count on Homestead as Your Fiduciary Compliance Partner

Navigating fiduciary obligations under ERISA is complex and the stakes are high. Contact us to learn more.